Page Contents

Buying probate homes sold by the Public administrator. We were asked to represent a buyer on the purchase of a probate home being sold by the County of Santa Clara Public Administrator for the estate of the deceased person who owned the home.

Our business is primarily focused on serving personal representatives (executors and administrators) of probate estates and successor trustees selling trust real estate. That means we list probate homes and trust homes for sale. Rarely do we represent buyers.

In this unique situation, we agreed to represent the buyer on this particular home. The buyer specifically reached out to us because they understood the importance of hiring a real estate agent that knows and understands the probate sale process.

Before we dive into what this type of sale looks like, let us understand the role of the Public Administrator with probate.

Buying Probate Homes Sold by the Public Administrator

What is a public administrator of an estate?

The Public Administrator is appointed by the Court to manage estates of people who die with a will, or without a will, and who do not have family members or friends capable or willing to act on behalf of their estate. Depending on the circumstances the Public Administrator gets appointed by the Superior Court to act as Trustee, Administrator, or Executor.

What is Probate?

“Probate is a legal process supervised by the court to administer an estate of a deceased person who dies with or without a will. The probate process takes place in the Probate Department of the Superior Court in the county where the deceased person lived at the time of death. The process allows for the transfer of a deceased person’s assets to the decedent’s heirs and beneficiaries.” Source: The Probate Process | Legal Process to Transfer Assets.

“Probate is a legal process supervised by the court to administer an estate of a deceased person who dies with or without a will. The probate process takes place in the Probate Department of the Superior Court in the county where the deceased person lived at the time of death. The process allows for the transfer of a deceased person’s assets to the decedent’s heirs and beneficiaries.” Source: The Probate Process | Legal Process to Transfer Assets.

Probate Homes | A Case Study

Probate is not one size fits all. This is a case study of one buyer client we represented making an offer on a probate home sold by the Santa Clara County Public Administrator. In this case study, we are providing information about the process.

The Petition for Probate was filed by the Public Guardian of the County of Santa Clara. The order for probate was granted and Letters of Administration were issued to the Public Administrator of the County of Santa Clara granting full authority under the Independent Administration of Estates Act (“IAEA”), with no bond required.

Independent Administration of Estates Act

Independent Administration of Estates Act (“IAEA”) is governed by the California Probate Code. It is a series of laws that allow an executor or administrator to manage or administer most aspects of a decedent’s estate without court supervision. Source: Independent Administration of Estates Act

In the short video below, estate planning and probate attorney, Jennifer F. Scharre explains the authorization to administer under the independent administration of estates act California.

Letters of Administration

Letters of Administration are issued by the Court when a person dies without a Will.

Letters of Administration (“Letters”) is the court-certified document that empowers the Administrator to act on behalf of the estate. Among many other things. with court-certified Letters, an administrator can sell real estate.

The home was listed for sale and marketed in the local and other bay area Multiple Listing Services.

- Showing appointments were scheduled online.

- Because the home is being sold during the COVID-19 Pandemic, very strict guidelines must be followed and a PEAD-V form signed by all parties before the showing appointment is confirmed and access provided.

An offer deadline was set and Offer Instructions were provided to real estate agents submitting offers on behalf of their buyer clients.

Conditions of this particular case study of a probate home for sale

- Offer must be written on the California Association of Realtors Probate Purchase Agreement.

- Purchase is “As-Is” – As-Is Addendum submitted with the offer.

- A no contingency sale – which means ALL contingencies must be removed with the offer.

- Cashier’s Check for 10% of the purchase price submitted with the offer.

- If financing, a lender approval letter is provided with the offer.

- If cash purchases, proof of funds to close escrow must be provided with the offer.

- Offers are presented in a sealed envelope.

Representing the buyer on this property involves a lot of time on the phone (COVID restrictions limiting face-to-face meetings) explaining the process and discussing strategy. Agents must be present at all times with their clients and others while on the property.

- 1 hour at the property for the showing

- 1 hour at the property with their contractor

- 3 hours at the property for inspections

- 4 hours going through the probate purchase agreement and disclosures, discussing the offer price, the risks of buying any property with NO contingencies, etc.

- 1 hour preparing the offer package and taking it to FedEx for delivery before the deadline.

In this case, the buyer chose to complete their due diligence on the property before submitting their offer. This is prudent given all contingencies were required to be removed at the time the offer is made. We tell clients, this is when you say “I do”. If your offer is accepted and there are no objections to the sale, you are expected to close escrow in the time specified in the offer. If you do not close, for any reason, your 10% deposit is at risk.

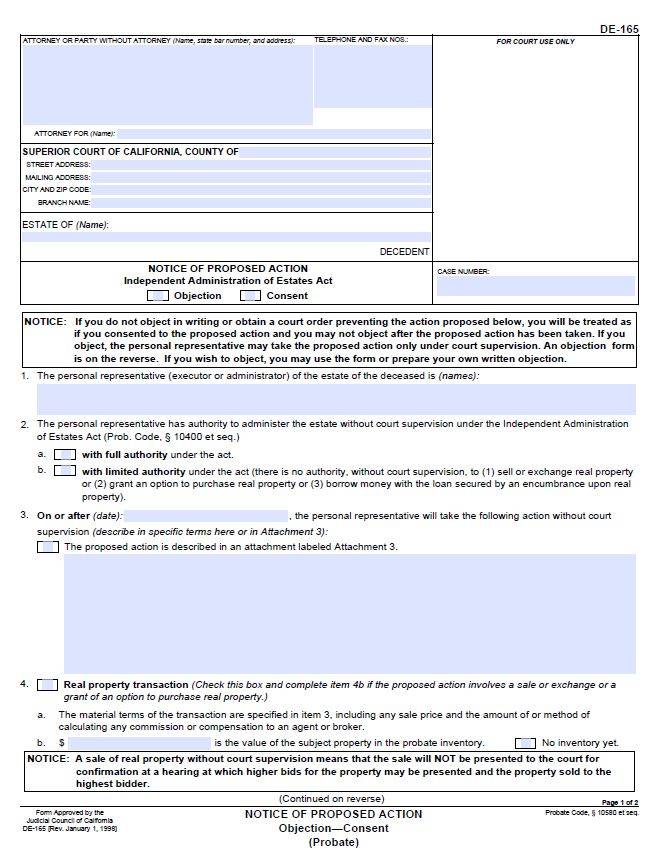

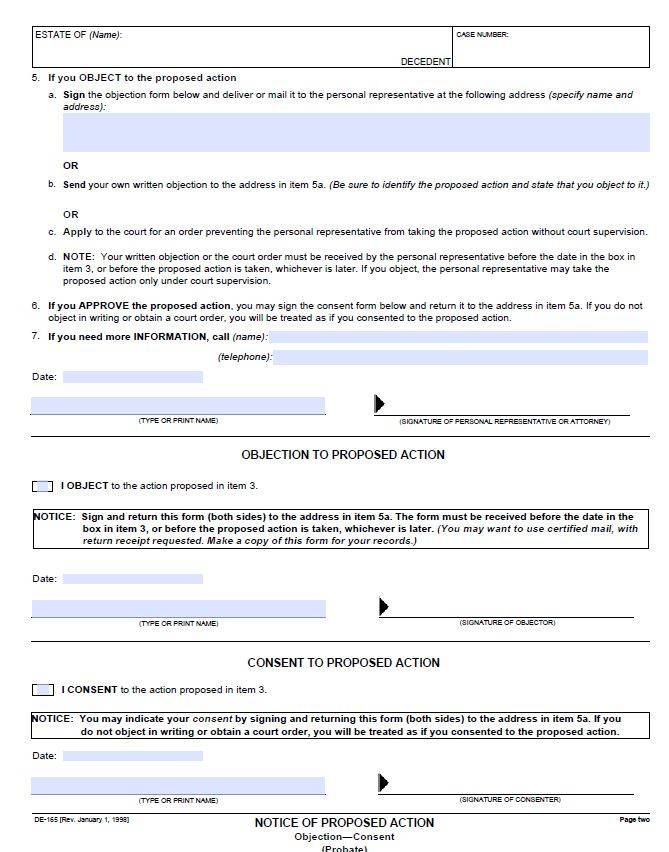

What is a Notice of Proposed Action?

Once an offer gets accepted by the Public Administrator or the Public Administrator’s representative, a Notice of Proposed Action must be mailed to all parties entitled to receive notice of the intention to sell the property.

A Notice of Proposed Action is a fillable judicial counsel form affectionally known as Form DE-165. The attorney for the estate completes the form providing all the required information.

A copy of the accepted Probate Purchase Agreement gets attached to the Notice of Proposed Action which is mailed or personally delivered to all parties entitled to receive the notice. People entitled to receive notice are:

- If the deceased person had a Will, devisees whose interest in the estate may be impacted by the proposed action, in this case, the sale of real property. Generally speaking, a devisee is a person who receives real property via a Will.

- If the deceased person did not have a Will, all heirs whose interest in the estate may be impacted by the proposed action, in this case, the sale of real property.

- All persons who filed a Request for Special Notice.

- If any portion of the estate will escheat to the State of California, and the interest would be impacted by the proposed action, the Attorney General receives the Notice of Proposed Action.

Each person receiving the notice must receive it at least 15 days before the date indicated on the Notice of Proposed Action. The person who mailed the notice must complete and sign a Proof of Service by Mail. If any Notices are personally delivered then the person delivering the notice must complete and sign a Proof of Service by Personal Delivery.

The notice and the proof of delivery get filed with the probate clerk. Any Consent Forms or Waiver Forms also get filed with the probate clerk.

If anyone signs a Waiver of Notice of Proposed Action (Form DE-166) then the Notice of Proposed Action does not need to be sent to those who have signed a Waiver.

The transaction of the sale of real property cannot be completed until after the end of the 15-day time period required. If all parties entitled to receive Notice have signed a Consent Form or a Waiver Form, then the 15-day clock does not apply.

What Happens if Someone Objects to the Notice of Proposed Action?

If an objection is filed, the Personal Representative, in this case, the Public Administrator, cannot proceed with the sale of the real property independently, under the Independent Administration of Estates Act, and must request instructions from the court regarding the proposed action or seek court supervision. When an objection to a sale happens, the sale goes under court supervision and is subject to an overbid process.

California Probate Sale Overbid Process

At the hearing to confirm the sale, the overbid process allows the public to participate to ensure the home is sold at the highest price. The buyer whose offer was accepted, in this case, my client, can participate in the overbid process.

Before the judge approves the accepted offer to purchase the property at the confirmation hearing, the judge asks if anyone in the courtroom is there to bid on the property. If no one bids the sale gets confirmed.

California Probate Code §10311 outlines the overbid process.

If someone wants to bid, the first minimum overbid is determined by the following formula.

“The offer is for an amount at least 10 percent more on the first ten thousand dollars ($10,000) of the original bid and 5 percent more on the amount of the original bid in excess of ten thousand dollars ($10,000).”

Example:

$800,000 is the list price and the price of the accepted offer.

$ 1,000 (10% of $10,000)

$ 39,500 (5% of $790,000)

Minimum overbid is $800,000 + $1,000 + $39,500 = $840,500

10% or $84,050.00 in the form of cash or cashier’s check is required at the hearing.

The judge at the hearing will establish incremental bidding.

Note: The same process applies when the personal representative has limited authority. A hearing is held to confirm the sale and the overbid process takes place.

Disclaimer: The information contained in this post is intended for informational purposes only. Always seek legal and or tax help from a qualified professional licensed to practice in the area you need help.

Contact Kathleen Daniels if you need help selling a probate home and are the personal representative with Letters granted by the court to act with full or limited authority under the independent administration of estates act (iaea). Probate sales can be complicated. We specialize in probate and we can help. We work exclusively with court-appointed personal representatives. We do not list homes being sold by the County of Santa Clara Public Administrator.

Contact Kathleen Daniels if you need help selling a probate home and are the personal representative with Letters granted by the court to act with full or limited authority under the independent administration of estates act (iaea). Probate sales can be complicated. We specialize in probate and we can help. We work exclusively with court-appointed personal representatives. We do not list homes being sold by the County of Santa Clara Public Administrator.